Ia Wealth Management Fundamentals Explained

The 2-Minute Rule for Private Wealth Management Canada

Table of ContentsTax Planning Canada Can Be Fun For EveryoneNot known Facts About Investment ConsultantThe 25-Second Trick For Financial Advisor Victoria BcExcitement About Private Wealth Management CanadaWhat Does Investment Representative Mean?The Only Guide to Investment Consultant

“If you used to be to buy something, say a tv or a pc, you'll want to know the specifications of itwhat tend to be the parts and just what it is capable of doing,†Purda explains. “You can consider purchasing economic information and help in the same manner. Men And Women need to find out what they're buying.†With economic advice, it's crucial that you understand that the merchandise is not bonds, shares or any other financial investments.it is such things as cost management, planning for your retirement or paying off debt. And like purchasing a computer from a reliable company, customers want to know they are purchasing financial guidance from a trusted professional. One of Purda and Ashworth’s best results is about the costs that economic planners demand their customers.

This presented real irrespective the fee structurehourly, commission, assets under administration or flat fee (in the learn, the buck property value fees was actually the exact same in each instance). “It however comes down to the worth proposition and uncertainty regarding the people’ part they don’t know very well what they've been getting back in trade for these costs,†states Purda.

Financial Advisor Victoria Bc Things To Know Before You Get This

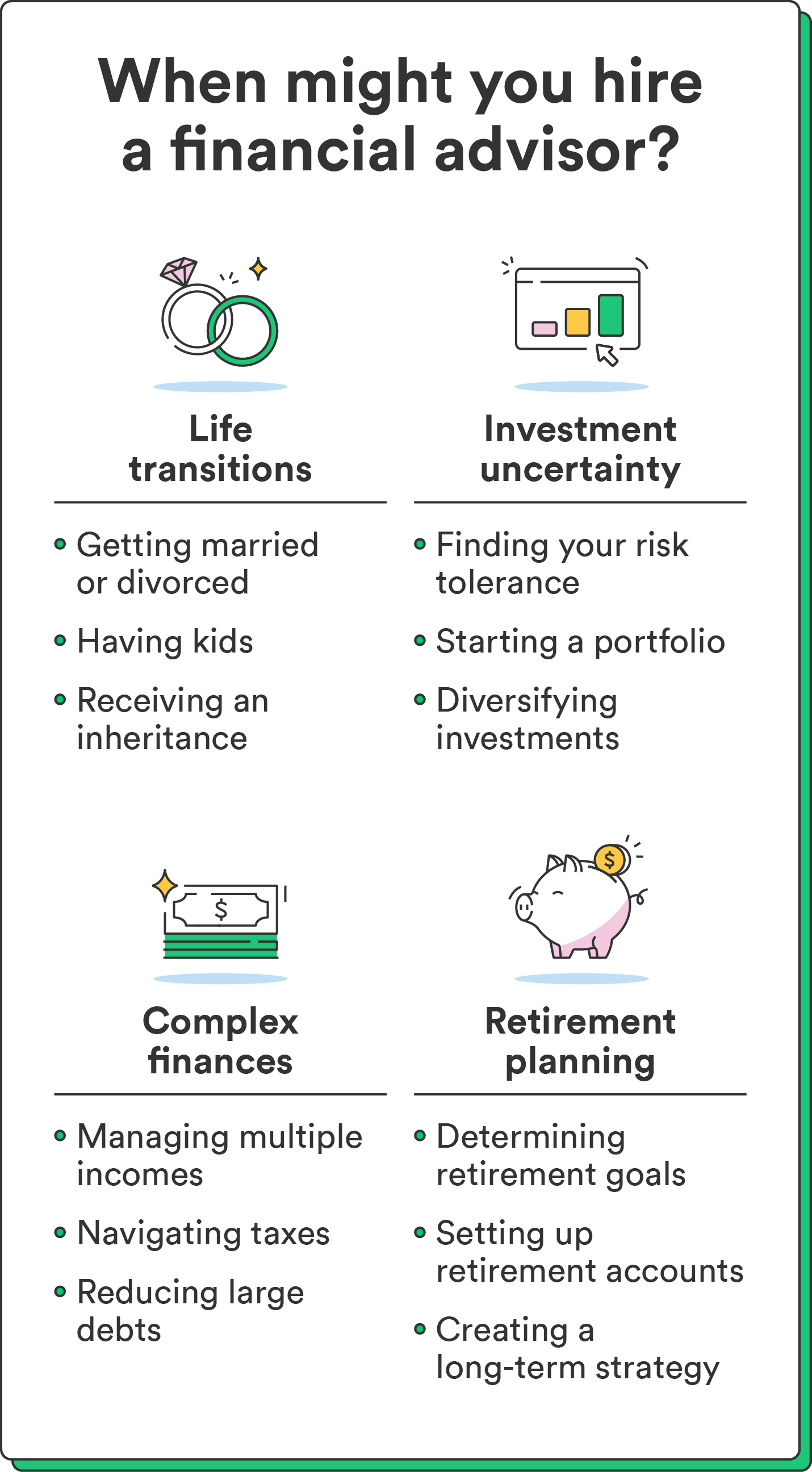

Hear this post When you listen to the expression economic specialist, just what comes to mind? A lot of people consider a specialized who is able to let them have monetary advice, specially when considering spending. That’s a good starting point, however it doesn’t decorate the total photo. Not really near! Financial advisors will help individuals with a lot of different cash targets too.

A monetary consultant will allow you to build wide range and protect it for your long lasting. They may be able calculate your future financial requirements and program tactics to stretch your own pension savings. Capable in addition advise you on when to start experiencing personal Security and ultizing money within pension records so you can stay away from any terrible penalties.

Things about Ia Wealth Management

They could let you figure out just what shared resources tend to be best for your needs and show you tips control and make probably the most of financial investments. Capable additionally support understand the threats and exactly what you’ll ought to do to produce your targets. A seasoned financial investment professional will also help you stay on the roller coaster of investingeven if your assets get a dive.

They may be able give you the direction you will need to make plans to make sure your wishes are performed. While can’t place a price tag from the reassurance that is included with that. Based on research conducted recently, the average 65-year-old few in 2022 needs to have around $315,000 conserved to cover health care prices in pension.

The Investment Representative Ideas

Since we’ve reviewed exactly what economic experts do, let’s dig in to the a variety. Here’s an excellent principle: All financial planners are economic advisors, although not all advisors are planners - https://soundcloud.com/lighthousewm. An economic coordinator targets assisting people generate plans to attain long-lasting goalsthings like starting a college investment or preserving for a down payment on a property

How do you know which financial advisor is right for you - https://pagespeed.web.dev/analysis/https-www-lighthousewealthvictoria-com/drv8epdit8?form_factor=mobile? Here are a few steps you can take to make sure you’re choosing best individual. What do you do when you have two bad choices to choose from? Easy! Get A Hold Of even more solutions. The greater amount of possibilities you really have, a lot more likely you may be to create an excellent choice

All about Retirement Planning Canada

Our very own Smart, Vestor program makes it easy for you by showing you around five monetary experts who is going to serve you. The good thing is actually, it is totally free to get regarding an advisor! And don’t forget about to get to the interview ready with a list of concerns to inquire of to figure out if they’re a good fit.

But tune in, because an expert is actually wiser as compared to independent financial advisor canada average keep does not let them have the ability to show how to handle it. Often, analysts are loaded with by themselves simply because they have significantly more degrees than a thermometer. If an advisor starts talking-down for your requirements, it's time for you to demonstrate to them the door.

Understand that! It’s essential that you along with your economic expert (anyone who it ends up being) are on alike page. Need an expert having a long-lasting investing strategysomeone who’ll motivate you to keep investing consistently perhaps the marketplace is up or down. retirement planning canada. In addition, you don’t would you like to assist someone that forces you to invest in something that’s as well risky or you are not comfortable with

What Does Independent Investment Advisor Canada Do?

That combine gives you the variation you need to successfully invest for any long term. Whenever study monetary advisors, you’ll most likely find the word fiduciary responsibility. All of this means is actually any specialist you hire needs to act in a fashion that benefits their own client and not their own self-interest.